Trending...

- Spokane: City Construction Projects Traffic Impacts Next Week

- Rep. Gina H. Curry and Dr. Conan Tu Inspire at Kopp Foundation for Diabetes Hybrid Fundraising Gala and National Leadership Forum

- City of Spokane Announces Next Chapter of HOME Starts Here Initiative

IQSTEL, Inc. (N A S D A Q: IQST) $IQST Featured in Litchfield Hills Research Report with $18 price target on high-margin growth strategy

CORAL GABLES, Fla. - Washingtoner -- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

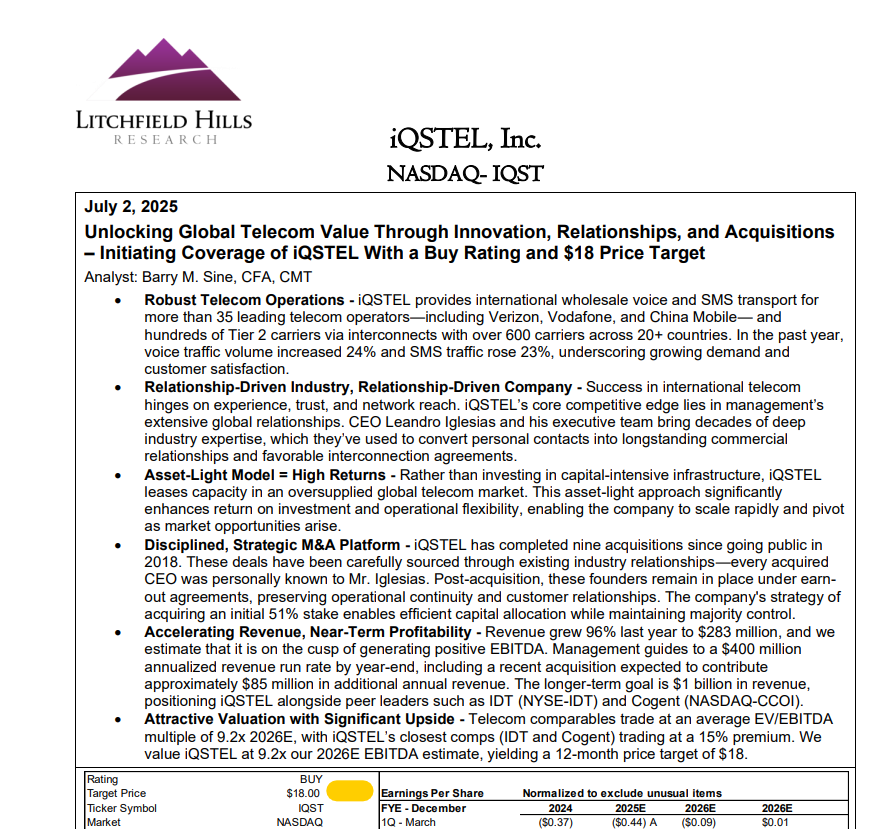

Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

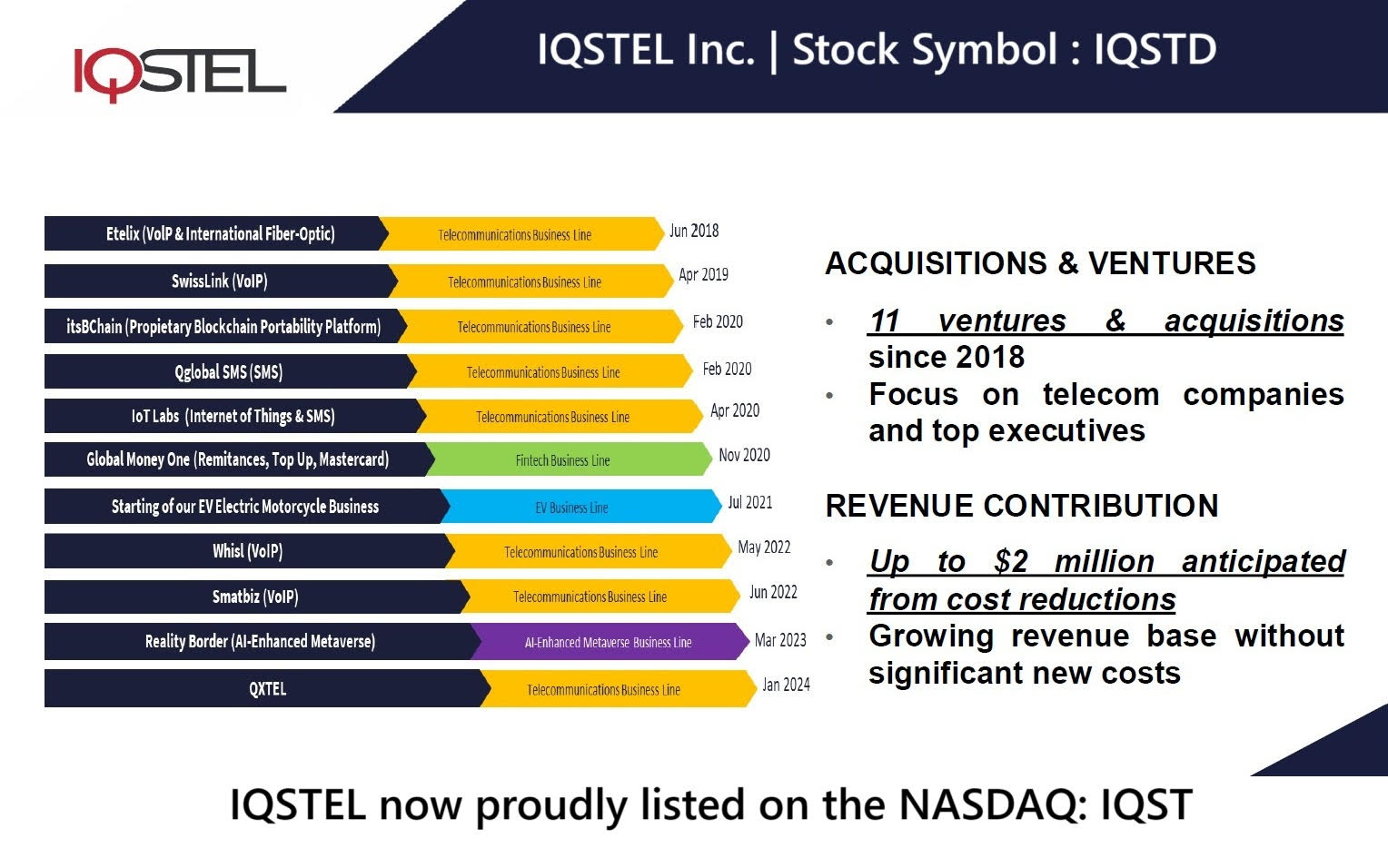

IQSTEL, Inc. (N A S D A Q: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers. This initiative is part of the IQST strategy to cross-sell high-margin, high-tech services to its existing client base, maximizing the value of its global relationships and accelerating revenue and EBITDA growth.

More on Washingtoner

IQST Becomes a Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

IQST Celebrates 120 Days on N A S D A Q with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to N A S D A Q. The letter included these key IQST highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

More on Washingtoner

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

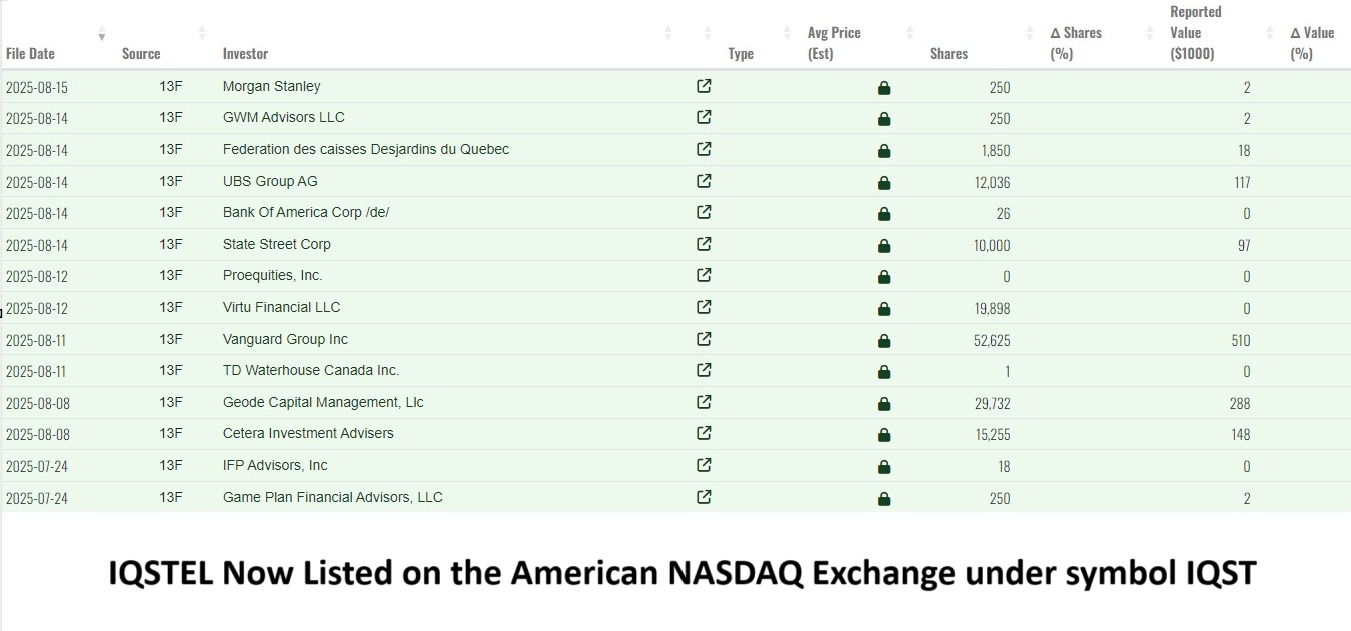

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU N A S D A Q shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

IQSTEL, Inc. (N A S D A Q: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers. This initiative is part of the IQST strategy to cross-sell high-margin, high-tech services to its existing client base, maximizing the value of its global relationships and accelerating revenue and EBITDA growth.

More on Washingtoner

- Milwaukee Job Corps Center: Essential Workforce Training—Admissions Now Open

- Aissist.io Launches Hybrid AI Workforce to Solve AI Pilot Failure for Customer Support Automation

- Christy Sports Makes Snowsports More Accessible for Families to Get Outside Together

- MainConcept Completes Management Buyout to Become Independent Company

- LIB Industry Expands Full-Series Salt Spray Corrosion Test Chambers to Meet Global Testing Standards

IQST Becomes a Debt-Free N A S D A Q Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

IQST Celebrates 120 Days on N A S D A Q with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to N A S D A Q. The letter included these key IQST highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

More on Washingtoner

- The Easy Way to Collect Every Wedding Photo from Your Guests - No App Needed

- REPRESENTATION REVOLUTION: FLM TV Network Launches as America's First Truly Diverse Broadcast Network

- GlobalBoost (BSTY) Announces Listing on Biconomy Exchange, Expanding Accessibility for Decentralized

- MetroWest wellness: Holliston farmhouse spa unveils Centerpoint Studio

- Cancer Survivor Roslyn Franken Marks 30-Year Milestone with Empowering Gift for Women

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU N A S D A Q shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

IQST Media Contact:

Company: IQSTEL, Inc. (N A S D A Q: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.IQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on Washingtoner

- Taraji P. Henson's Boris Lawrence Henson Foundation (BLHF) Announce 5th Annual Can We Talk? Arts & Wellness Summit and "i AM The Table Benefit Brunch

- Spokane: City Construction Projects Traffic Impacts Next Week

- Mullins McLeod Surges Into SC Governor's Race with $1.4 Million Raised in First Quarter; Most from His Own Commitment, Not Political Pockets

- Mensa Members Put Brainpower to Work for Literacy

- Rep. Gina H. Curry and Dr. Conan Tu Inspire at Kopp Foundation for Diabetes Hybrid Fundraising Gala and National Leadership Forum

- Elliott Expands Investment Services with Naviark App Launch

- Statement from Tacoma City Council Members Sandesh Sadalge and Olgy Diaz on Defending Local Control of Law Enforcement

- Restoration Dental Introduces YOMI Robot for High-Precision Implant Surgery in Oklahoma

- Elite Rooter Creates Jobs and Expands Reach Coast to Coast with New Tampa, FL Plumbing Location

- "Super Leftist", the new poetry book by Pierre Gervois

- RNHA FL Unveils Bold New Leadership Ahead of 2026 Elections

- ASI Honors Client Achievements at 27th Annual iNNOVATIONS Conference

- Lightship Security and the OpenSSL Corporation Submit OpenSSL 3.5.4 for FIPS 140-3 Validation

- WADA AWARDS - where Diamonds melt into glamour

- First Nations Bank of Canada Partners with KYC2020 to Strengthen AML Screening and Monitoring Capabilities

- Bitcoin will still be the leader in the cryptocurrency market in 2025, and WOA Mining enthusiasts will earn passive income

- Triumph Thru Tears Premieres at 55th Anniversary Pamoja Celebration at the University of Georgia

- Helping Haircare Brands Launch with Confidence: Bond & Bloom Innovation Group Leads in Product Development

- Holiday Fineries at the Wineries on the Shawangunk Wine Trail

- Chadwick Twillman Demands Resignation of MLive Editor Joey Oliver for Publishing Deceptive Hit Piece