Trending...

- Juventix Regenerative Medical Announces Strategic Partnership with Juvasonic® to Expand Needle-Free Biologic Delivery Platform

- ARCH Dental + Aesthetics Unveils New Website for Enhanced Patient Experience

- New Website Launch Positions TekTone Builders As Tulsa's Commercial Construction Leader

iQSTEL, Inc. (Stock Symbol: IQST) $IQST Also Signs MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Plus $1 Million Subsidiary Sale with Stock Dividend to Shareholders

CORAL GABLES, Fla. - Washingtoner -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

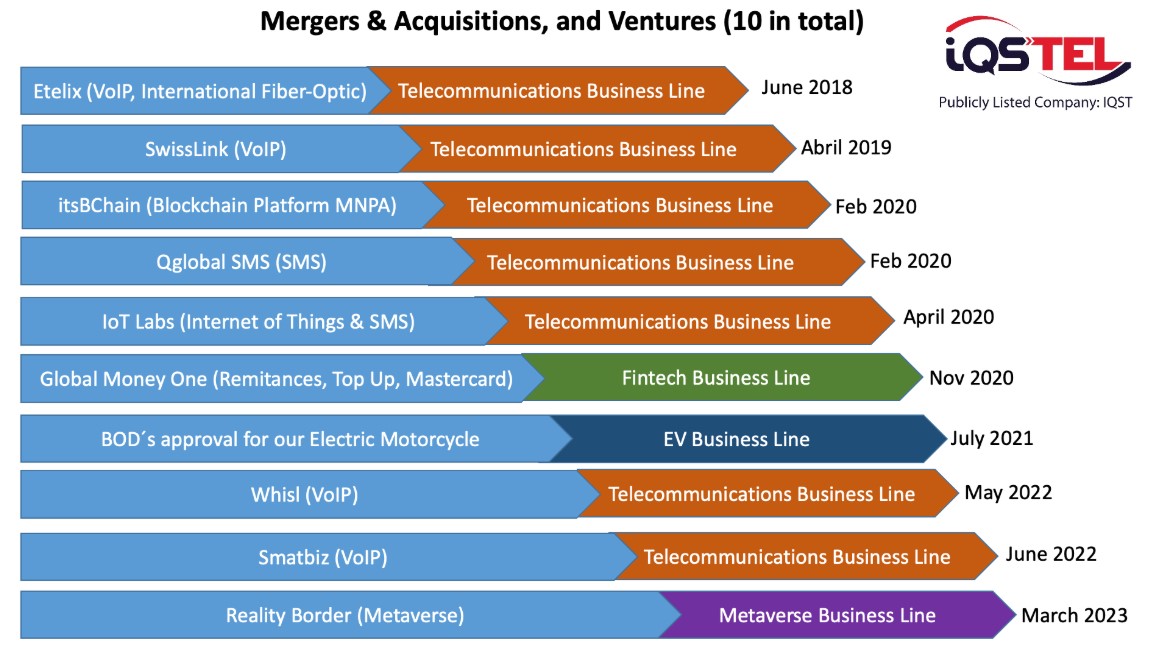

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on Washingtoner

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on Washingtoner

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on Washingtoner

- Zareef Hamid Analyzes How AI is Redefining Financial Services

- Spokane: Suspects in Custody, Two Firearms Recovered, After Early Morning Drive-by Shooting

- Brad Miller Joins Keystone as President of CoreAI

- June 2-8 is Medicare Fraud Prevention Week

- CCHR Warns: Millions of Children Exposed to Risky Psychiatric Drugs

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on Washingtoner

- First-Ever Blueberry Boost Accelerator Seeks Next Generation of Food and Consumer Product Innovation

- RNHA Named Official Community Partner of the First Annual CPAC Latino 2025

- From Robinhood to APT Miner: New Passive Income Opportunities in the Digital Asset Era

- JU Miner Launches Free Mining: Bitcoin, Dogecoin, and Litecoin

- Seattle and Austin Luxury Home Builder, Proform Builds Launches New Website

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on Washingtoner

- Tomorrow's World Today Shines Bright with Four Telly Awards at the 46th Annual Telly Awards

- 6 Love Sports and Eight Sleep Announce Partnership Miami Women's Padel League Rebranded as the Eight Sleep Miami Women's Padel League by 6 Love Sports

- Spokane: Early morning shooting in Shadle area results in an arrest, investigation ongoing

- The TOBU RAILWAY X COFFEE PROJECT Supports Nikko Tourism and Fosters English Speaking Guides, Through November 27, 2026

- Al-Tabbaa & Hackett: Fixed Rates Improve For Savers

- Non-Citizen NY Travelers Face Extra Scrutiny at Local Airports: Attorney Robert Tsigler Featured in Gothamist

- $400 Million Run Rate in 2025 for Global Telcom Leader as a Result of Definitive Fintech Acquisition, Fast-Tracking $1 Billion Growth Plan: IQSTEL Inc

- Chosen Launches Mobile Family Closet to Serve Foster, Adoptive, and Kinship Families Across Southeastern Wisconsin

- New Release Explores Grit, Wit, and Appalachian Life in We Saved Ourselves, Kinda

- WNC Roofing, LLC Opens Spartanburg, SC Location After a Decade of Serving the Upstate

- June Is Men's Health Month 2025:

- Velocity Performance Alliance Shifts Into High Gear with Luxury Auto Real Estate Platform Ahead of NASCAR Debut

- Floating Water Ramp for Pups is Still Making a Splash

- Alkermes to Present New Research Related to ALKS 2680 at SLEEP 2025

- UIFCA Wealth Academy's Revolutionary UIFCA(UFCA) Token Gains Momentum in AI-Powered Investment Market

- New Website Launch Positions TekTone Builders As Tulsa's Commercial Construction Leader

- Inframark Expands Its Capabilities and Presence in Arizona, Adding Wastewater Experts Mehall Contracting

- FilmHedge Is Letting A.I. Into the Deal Room—And Hollywood Will Never Be the Same

- This Artificial Intelligence Platform Could Change How Hollywood Gets Funded Forever

- $100 Million Financing Unlocked for Aggressive Acquisition and Growth Strategy Including Plan to Acquire Remote Lottery Platform: Stock Symbol: LTRY