Trending...

- UK Financial Ltd Board of Directors Establishes Official News Distribution Framework and Issues Governance Decision on Official Telegram Channels

- Kentucky Judges Ignore Evidence, Prolong Father's Ordeal in Baseless Case

- UK Financial Ltd Sets Official 30-Day Conversion Deadline for Three Exchange Listed Tokens Ahead of Regulated Upgrade

IQSTEL, Inc. (N A S D A Q: IQST) $IQST is Featured in Litchfield Hills Research Report with $18 price target on high-margin growth strategy

CORAL GABLES, Fla. - Washingtoner -- IQSTEL, Inc. (N A S D A Q: IQST) $IQST — a global technology leader operating at the intersection of Telecommunications, Fintech, Artificial Intelligence (AI), and Cybersecurity — is capturing investor attention with bold growth forecasts, a solid balance sheet, and expanding institutional support.

With a projected $430 million in 2026 organic revenue (up 26% year-over-year), and a $500,000 stock dividend planned for shareholders by year-end 2025, IQSTEL is positioning itself as one of the most diversified and fastest-growing AI-integrated digital communications companies on Nasdaq.

AI, Fintech, and Telecom Synergy Powering the Next Phase of Growth

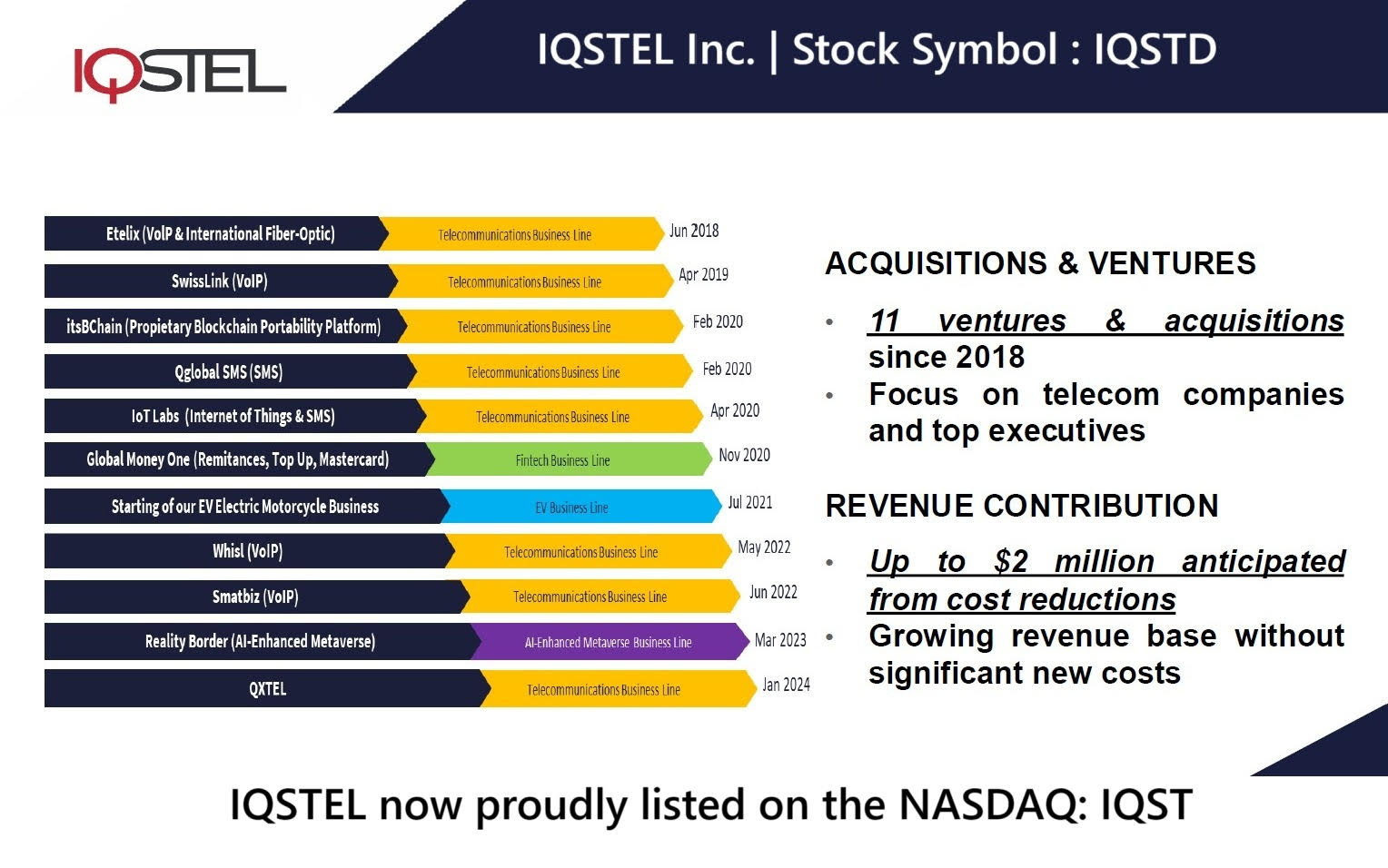

IQSTEL operates in 21 countries and serves a global base of telecom and enterprise clients. The company's four synergistic divisions — Telecom, Fintech, Artificial Intelligence, and Cybersecurity — create a vertically integrated ecosystem designed for high-margin, scalable growth.

IQSTEL's 2026 revenue forecast of $430 million builds on its 2025 target of $340 million, following $283 million in revenue for FY 2024. The company's track record of meeting or exceeding its forecasts reflects disciplined execution and strong demand across its business lines.

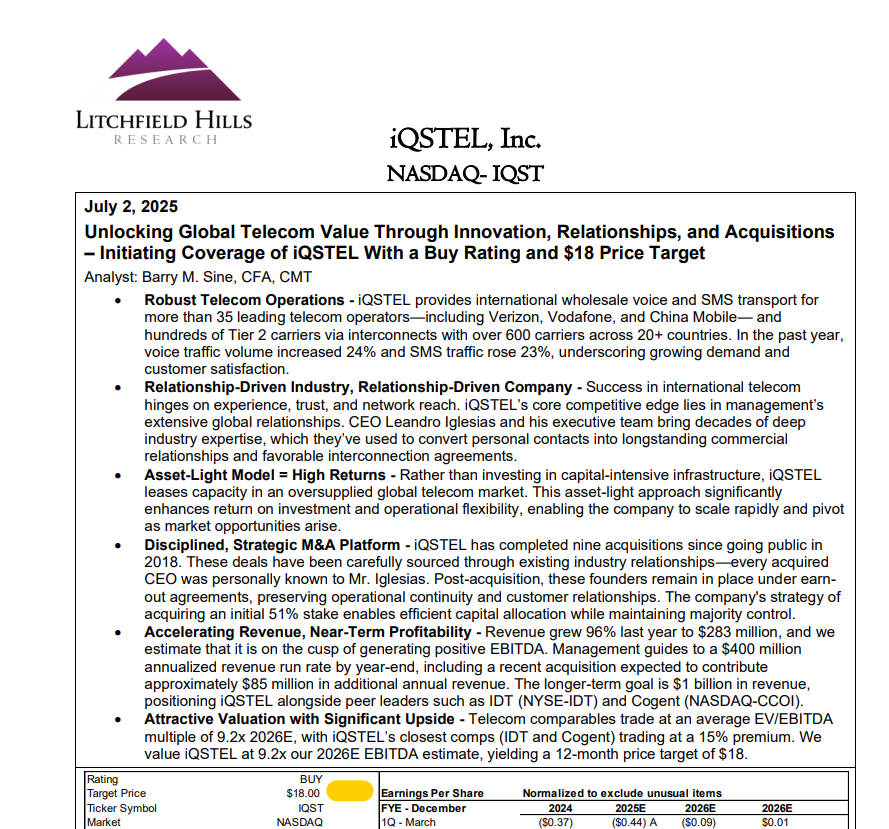

A recent Litchfield Hills Research report reaffirmed this momentum with an $18 price target, citing IQSTEL's "high-margin growth strategy, strong management discipline, and AI-driven product expansion" as key drivers of long-term shareholder value.

"IQSTEL's diversified business model, expanding global footprint, and AI integration strategy give it a unique edge in multiple trillion-dollar markets," said Leandro Jose Iglesias, President and CEO. "Our roadmap to $1 billion in revenue by 2027 is well within reach."

Debt-Free Nasdaq Company With a Clean Capital Structure

On October 9, 2025, IQSTEL achieved a milestone few small-cap Nasdaq companies can claim — becoming a fully debt-free company with no convertible notes or warrants outstanding.

The company also strengthened its equity position with a $6.9 million debt reduction, equivalent to almost $2 per share, reinforcing shareholder value and balance sheet flexibility.

With $17.41 in assets per share, IQSTEL now stands out as a high-transparency, debt-free Nasdaq issuer — a rare combination that has begun attracting increased institutional investment interest.

More on Washingtoner

Shareholder Value Expansion: $500,000 Stock Dividend and CYCU Strategic Alliance

In conjunction with its financial transformation, IQSTEL announced plans to distribute a $500,000 stock dividend in 2025 as part of its strategic AI-cybersecurity partnership with Cycurion, Inc. (N A S D A Q: CYCU).

This partnership includes a $1 million stock exchange agreement and joint development of AI-enhanced cybersecurity solutions. Together, IQSTEL's Reality Border AI division and CYCU's ARx platform have completed Phase One of a next-generation cyber defense rollout — integrating secure AI agents with built-in threat prevention and proactive security.

This alliance not only expands IQSTEL's footprint in the AI and cybersecurity markets but also represents a tangible return of value to shareholders through the planned stock dividend.

Fintech Acceleration Through Globetopper Acquisition

IQSTEL's Fintech division continues to be a major EBITDA growth engine. Following the July 1, 2025 acquisition of Globetopper, the division delivered $16 million in Q3 2025 revenue and $110,000 in EBITDA, achieving cash-flow-positive performance in its first full quarter under IQSTEL's management.

Leveraging a global telecom network of over 600 Tier-1 operators, IQSTEL is now cross-selling Globetopper's fintech services to its existing clients — a strategy expected to drive substantial high-margin revenue growth in 2026 and 2027.

Strategic Forecast: $15 Million EBITDA in 2026 and $1 Billion Revenue by 2027

IQSTEL's management has set a clear and credible financial roadmap:

Innovation Spotlight: AI-Telecom Integration for the $750 Billion Global Market

IQSTEL recently launched IQ2Call.ai, a next-generation AI-telecom integration platform designed to revolutionize customer engagement and automation in the $750 billion global telecommunications market.

Litchfield Hills Research Coverage: $18 Price Target and "High Margin Growth" Thesis

In October 2025, Litchfield Hills Research issued a comprehensive report on IQSTEL, assigning an $18 price target and highlighting the company's diversified revenue streams, disciplined cost structure, and clean balance sheet as key strengths.

More on Washingtoner

The report praised IQSTEL's "strategic execution, vertical integration across AI and telecom, and consistent forecast achievement" — positioning the company as an undervalued growth story in the AI and digital infrastructure space.

Institutional Confidence and Nasdaq Momentum

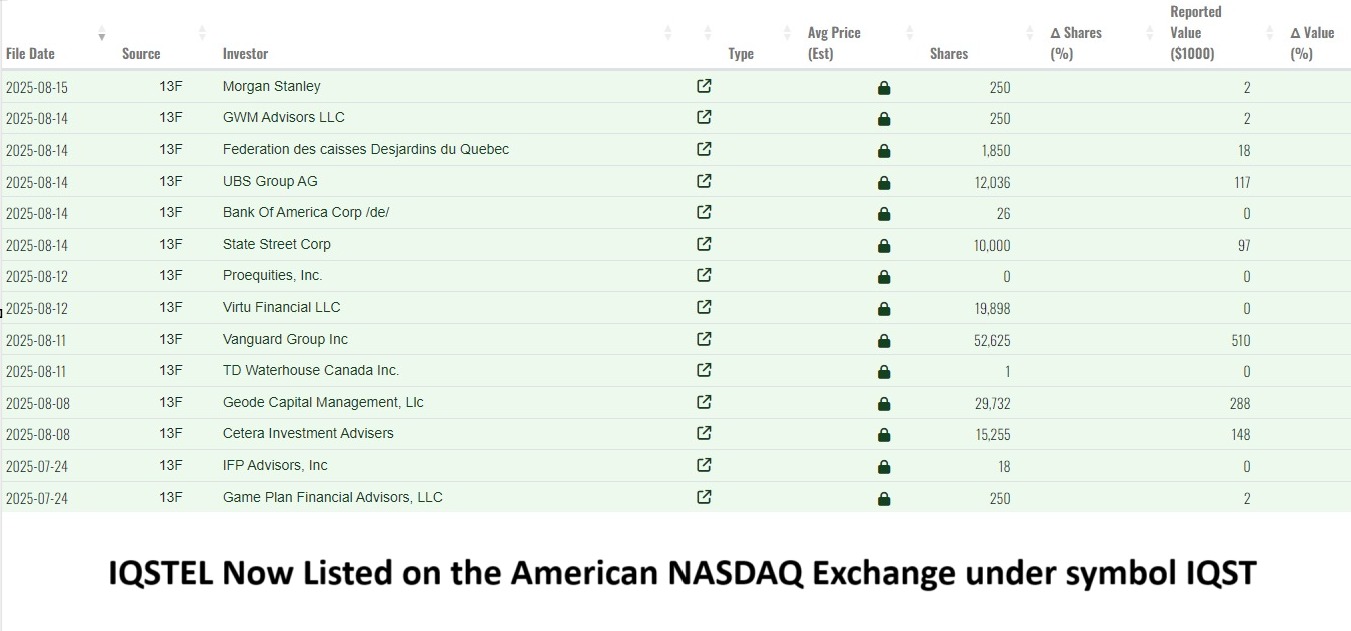

Since uplisting to Nasdaq earlier this year, IQSTEL has rapidly gained traction among institutional investors.

In its 120-Day Shareholder Letter (September 24, 2025), the company reported:

A Debt-Free, AI-Driven Growth Story with Global Scale

IQSTEL's combination of diversified revenue, global market reach, and strong financial discipline gives investors a rare opportunity to participate in a multi-sector AI and digital transformation leader.

With no debt, no convertible notes, no warrants, and $17.41 in assets per share, IQSTEL enters 2026 with one of the cleanest capital structures among its peers — and a clear roadmap toward sustainable profitability, shareholder rewards, and billion-dollar revenue potential.

Key Investor Highlights

About IQSTEL, Inc. (N A S D A Q: IQST)

IQSTEL, Inc. is a global AI and digital communications company offering cutting-edge solutions in Telecommunications, Fintech, Blockchain, Artificial Intelligence, and Cybersecurity. With operations in 21 countries, IQSTEL provides high-value, high-margin services to a global customer base spanning over 600 telecom operators and enterprises. The company's mission is to leverage innovation to build a more connected, intelligent, and secure digital world.

Website: www.IQSTEL.com

Investor Page: www.landingpage.iqstel.com

Contact: Leandro Jose Iglesias, President & CEO

Email: investors@iqstel.com

Phone: +1 (954) 951-8191

Country: United States

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a projected $430 million in 2026 organic revenue (up 26% year-over-year), and a $500,000 stock dividend planned for shareholders by year-end 2025, IQSTEL is positioning itself as one of the most diversified and fastest-growing AI-integrated digital communications companies on Nasdaq.

AI, Fintech, and Telecom Synergy Powering the Next Phase of Growth

IQSTEL operates in 21 countries and serves a global base of telecom and enterprise clients. The company's four synergistic divisions — Telecom, Fintech, Artificial Intelligence, and Cybersecurity — create a vertically integrated ecosystem designed for high-margin, scalable growth.

IQSTEL's 2026 revenue forecast of $430 million builds on its 2025 target of $340 million, following $283 million in revenue for FY 2024. The company's track record of meeting or exceeding its forecasts reflects disciplined execution and strong demand across its business lines.

A recent Litchfield Hills Research report reaffirmed this momentum with an $18 price target, citing IQSTEL's "high-margin growth strategy, strong management discipline, and AI-driven product expansion" as key drivers of long-term shareholder value.

"IQSTEL's diversified business model, expanding global footprint, and AI integration strategy give it a unique edge in multiple trillion-dollar markets," said Leandro Jose Iglesias, President and CEO. "Our roadmap to $1 billion in revenue by 2027 is well within reach."

Debt-Free Nasdaq Company With a Clean Capital Structure

On October 9, 2025, IQSTEL achieved a milestone few small-cap Nasdaq companies can claim — becoming a fully debt-free company with no convertible notes or warrants outstanding.

The company also strengthened its equity position with a $6.9 million debt reduction, equivalent to almost $2 per share, reinforcing shareholder value and balance sheet flexibility.

With $17.41 in assets per share, IQSTEL now stands out as a high-transparency, debt-free Nasdaq issuer — a rare combination that has begun attracting increased institutional investment interest.

More on Washingtoner

- Beycome Closes $2.5M Seed Round Led by InsurTech Fund

- City of Vancouver Delaying Haven Treatment Center Facility's Certificate of Occupancy

- City of Spokane, Spokane County, Spokane Regional Emergency Communications Approve Interlocal Agreement to Support Safe, Coordinated Transition of Emergency Communication Services

- Tru by Hilton Columbia South Opens to Guests

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes

Shareholder Value Expansion: $500,000 Stock Dividend and CYCU Strategic Alliance

In conjunction with its financial transformation, IQSTEL announced plans to distribute a $500,000 stock dividend in 2025 as part of its strategic AI-cybersecurity partnership with Cycurion, Inc. (N A S D A Q: CYCU).

This partnership includes a $1 million stock exchange agreement and joint development of AI-enhanced cybersecurity solutions. Together, IQSTEL's Reality Border AI division and CYCU's ARx platform have completed Phase One of a next-generation cyber defense rollout — integrating secure AI agents with built-in threat prevention and proactive security.

This alliance not only expands IQSTEL's footprint in the AI and cybersecurity markets but also represents a tangible return of value to shareholders through the planned stock dividend.

Fintech Acceleration Through Globetopper Acquisition

IQSTEL's Fintech division continues to be a major EBITDA growth engine. Following the July 1, 2025 acquisition of Globetopper, the division delivered $16 million in Q3 2025 revenue and $110,000 in EBITDA, achieving cash-flow-positive performance in its first full quarter under IQSTEL's management.

Leveraging a global telecom network of over 600 Tier-1 operators, IQSTEL is now cross-selling Globetopper's fintech services to its existing clients — a strategy expected to drive substantial high-margin revenue growth in 2026 and 2027.

Strategic Forecast: $15 Million EBITDA in 2026 and $1 Billion Revenue by 2027

IQSTEL's management has set a clear and credible financial roadmap:

- 2025 Revenue Target: $340 million

- 2026 Revenue Forecast: $430 million (26% organic growth)

- 2026 EBITDA Run Rate Goal: $15 million

- 2027 Revenue Goal: $1 billion

Innovation Spotlight: AI-Telecom Integration for the $750 Billion Global Market

IQSTEL recently launched IQ2Call.ai, a next-generation AI-telecom integration platform designed to revolutionize customer engagement and automation in the $750 billion global telecommunications market.

Litchfield Hills Research Coverage: $18 Price Target and "High Margin Growth" Thesis

In October 2025, Litchfield Hills Research issued a comprehensive report on IQSTEL, assigning an $18 price target and highlighting the company's diversified revenue streams, disciplined cost structure, and clean balance sheet as key strengths.

More on Washingtoner

- "BigPirate" Sets Sail: A New Narrative-Driven Social Casino Adventure

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

- Plainsight Announces Jonathan Simkins as New CEO, Succeeding Kit Merker

- Women's Everyday Safety Is Changing - The Blue Luna Shows How

- Microgaming Unveils Red Papaya: A New Studio Delivering Cutting-Edge, Feature-Rich Slots

The report praised IQSTEL's "strategic execution, vertical integration across AI and telecom, and consistent forecast achievement" — positioning the company as an undervalued growth story in the AI and digital infrastructure space.

Institutional Confidence and Nasdaq Momentum

Since uplisting to Nasdaq earlier this year, IQSTEL has rapidly gained traction among institutional investors.

In its 120-Day Shareholder Letter (September 24, 2025), the company reported:

- 12 institutional investors now hold approximately 4% of IQST shares.

- $35 million July revenue, reflecting a $400 million annualized run rate five months ahead of schedule.

- Continued leadership in telecom and fintech, with AI and cybersecurity now driving accelerated growth.

A Debt-Free, AI-Driven Growth Story with Global Scale

IQSTEL's combination of diversified revenue, global market reach, and strong financial discipline gives investors a rare opportunity to participate in a multi-sector AI and digital transformation leader.

With no debt, no convertible notes, no warrants, and $17.41 in assets per share, IQSTEL enters 2026 with one of the cleanest capital structures among its peers — and a clear roadmap toward sustainable profitability, shareholder rewards, and billion-dollar revenue potential.

Key Investor Highlights

- $430 Million 2026 Organic Revenue Forecast (+26% YoY)

- Debt-Free Nasdaq Company with no convertibles or warrants

- $500,000 Stock Dividend Planned for 2025

- $15 Million EBITDA Run Rate Target for 2026

- $1 Billion Revenue Goal for 2027

- $17.41 Assets per Share, strong balance sheet and equity position

- AI-Cybersecurity Alliance with Cycurion (CYCU)

- Litchfield Hills Research $18 Price Target

- Global Operations in 21 Countries serving 600+ telecom operators

About IQSTEL, Inc. (N A S D A Q: IQST)

IQSTEL, Inc. is a global AI and digital communications company offering cutting-edge solutions in Telecommunications, Fintech, Blockchain, Artificial Intelligence, and Cybersecurity. With operations in 21 countries, IQSTEL provides high-value, high-margin services to a global customer base spanning over 600 telecom operators and enterprises. The company's mission is to leverage innovation to build a more connected, intelligent, and secure digital world.

Website: www.IQSTEL.com

Investor Page: www.landingpage.iqstel.com

Contact: Leandro Jose Iglesias, President & CEO

Email: investors@iqstel.com

Phone: +1 (954) 951-8191

Country: United States

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on Washingtoner

- City of Spokane Prepared for Forecasted Winds

- A New Soul Album: Heart Of Kwanzaa, 7-Day Celebration

- Allegiant Management Group Named 2025 Market Leader in Orlando by PropertyManagement.com

- NAFMNP Awarded USDA Cooperative Agreement to Continue MarketLink Program Under FFAB

- Costa Oil - 10 Minute Oil Change Surpasses 70 Locations with Construction of San Antonio, TX Stores — Eyes Growth Via Acquisition or Being Acquired

- LaTerra and Respark Under Contract with AIMCO to Acquire a $455M, 7-Property Chicago Multifamily Portfolio

- Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

- VSee Health (N A S D A Q: VSEE) Secures $6.0M At-Market Investment, Accelerates Expansion as Revenues Surge

- Children Rising Appoints Marshelle A. Wilburn as New Executive Director

- Fairmint CEO Joris Delanoue Elected General Director of the Canton Foundation

- Sleep Basil Mattress Co.'s Debuts New Home Page Showcasing Performance Sleep Solutions for Active Denver Lifestyles

- Bent Danholm Joins The American Dream TV as Central Florida Host

- The Nature of Miracles Celebrates 20th Anniversary Third Edition Published by DreamMakers Enterprises LLC

- Artificial Intelligence Leader Releases Children's Book on Veterans Day

- Felicia Allen Hits #1 Posthumously with "Christmas Means Worship"

- CCHR Documentary Probes Growing Evidence Linking Psychiatric Drugs to Violence

- Tokenized Real-World Assets: Iguabit Brings Institutional Investment Opportunities to Brazil

- MEX Finance meluncurkan platform keuangan berbasis riset yang berfokus pada data, logika, dan efisiensi pengambilan keputusan investasi

- From MelaMed Wellness to Calmly Rooted: A New Chapter in Functional Wellness

- New Angles US Group Founder Alexander Harrington Receives Top U.S. Corporate Training Honor and Leads Asia-Pacific Engagements in Taiwan